Smooth Success: 8 Essential Steps to Open an Independent Administration Probate in Plano, TX

Losing a loved one is difficult, and handling their estate can add stress during an already emotional time. Fortunately, Texas offers independent administration probate—a simplified, cost-effective way to manage and distribute an estate. If you’re in Plano, TX, and want to open an independent administration probate, following the right steps can ensure a smooth process while honoring your loved one’s wishes. At G.J. Chavez & Associates, P.C., we’re committed to helping families navigate probate with clarity and compassion. Here’s an in-depth, step-by-step guide to help you get started.

Table of Contents

1. Confirm Eligibility for Independent Administration

Texas independent administration is designed for estates where the deceased has a valid will that specifically authorizes independent administration, or all heirs agree to this process. To confirm eligibility:

- Review the will for independent administration language.

- If there is no will, all heirs must consent in writing.

- Consult a probate attorney to ensure you meet all requirements.

Why This Matters:

Independent administration saves time and money, allowing the executor to manage the estate with minimal court oversight.

2. File the Required Probate Application with the Court

Begin by filing an application for probate in the Collin County Probate Court (serving Plano, TX). This application should include:

- The original will (if applicable)

- Death certificate

- Names and addresses of heirs and beneficiaries

- Request for appointment as independent administrator

Tip:

Legal assistance ensures your application is accurate and complete, avoiding delays.

3. Attend the Probate Hearing

After filing, the court schedules a hearing—usually within a few weeks. During this hearing:

- The judge reviews the application and will.

- The court confirms the validity of the will or heirship.

- The judge appoints the independent administrator.

Advice:

Dress appropriately and be prepared to answer basic questions about the deceased and their estate.

4. Take the Oath and File a Bond (If Required)

Once appointed, the independent administrator must take an oath to faithfully execute their duties. Sometimes, the court requires a bond to protect the estate’s assets.

- The bond amount depends on the estate’s value and court discretion.

- Some wills waive the bond requirement; check the will’s language.

Reminder:

You cannot act as administrator until the oath is taken and any required bond is filed.

5. Notify Heirs, Beneficiaries, and Creditors

Texas law requires prompt notification of all interested parties:

- Send legal notice to heirs and beneficiaries, informing them of the probate.

- Publish a notice to creditors in a local newspaper.

- Directly notify known secured creditors.

Why This Is Critical:

These notices protect your administration from future disputes and allow creditors to make claims.

6. Inventory and Appraise Estate Assets

The administrator must identify, inventory, and appraise all estate assets:

- Real estate, bank accounts, investments, vehicles, personal property, etc.

- File an inventory, appraisement, and list of claims with the court (or file an affidavit in lieu, if permitted).

Pro Tip:

Accurate documentation ensures transparency and eases final distribution.

7. Settle Debts and Distribute Estate Assets

Pay valid debts and taxes from the estate before distributing assets to heirs or beneficiaries:

- Satisfy creditor claims in the order of legal priority.

- Resolve outstanding expenses, such as funeral costs, taxes, or legal fees.

- Distribute remaining assets according to the will or Texas intestacy law.

Caution:

Improper payment order can expose the administrator to liability—legal guidance is invaluable.

8. Close the Estate and File Final Reports

When all debts are paid and assets distributed, the final step is closing the estate:

- Prepare a final accounting for heirs (and sometimes the court).

- File a motion for discharge or closing affidavit.

- Obtain a court order releasing you from further duties as administrator.

Final Tip:

Keep thorough records throughout the process to simplify closing and prevent disputes.

Frequently Asked Questions About Independent Administration Probate in Plano, TX

Q: How long does independent administration take in Texas?

A: Typically, 6–12 months, depending on estate complexity and creditor claims.

Q: Can the process be contested?

A: Yes, if heirs disagree or believe the will is invalid, the process can become contested and revert to dependent administration.

Q: What if there’s no will?

A: All heirs must agree in writing to independent administration.

Q: Can I serve without a lawyer?

A: While possible, legal guidance is highly recommended to avoid costly mistakes.

Navigate Probate with Confidence

Independent administration probate streamlines estate management for Plano, TX, families. By following these eight essential steps and partnering with an experienced probate attorney, you can honor your loved one’s wishes and protect your family’s future. G.J. Chavez & Associates, P.C. is here to guide you every step of the way. If you’re ready to open probate or have questions about the process, contact us for personalized assistance.

For more details or to schedule a consultation, visit G.J. Chavez & Associates, P.C..

Image Prompts

Background Image Prompt:

Design a seamless, modern, geometrical pattern with interlocking hexagons, chevrons, and subtle judicial icons (gavel, scales, court tables) in slate, sandstone, charcoal, and gold accents. Artsy, attractive, non-distracting, high-resolution, no text.

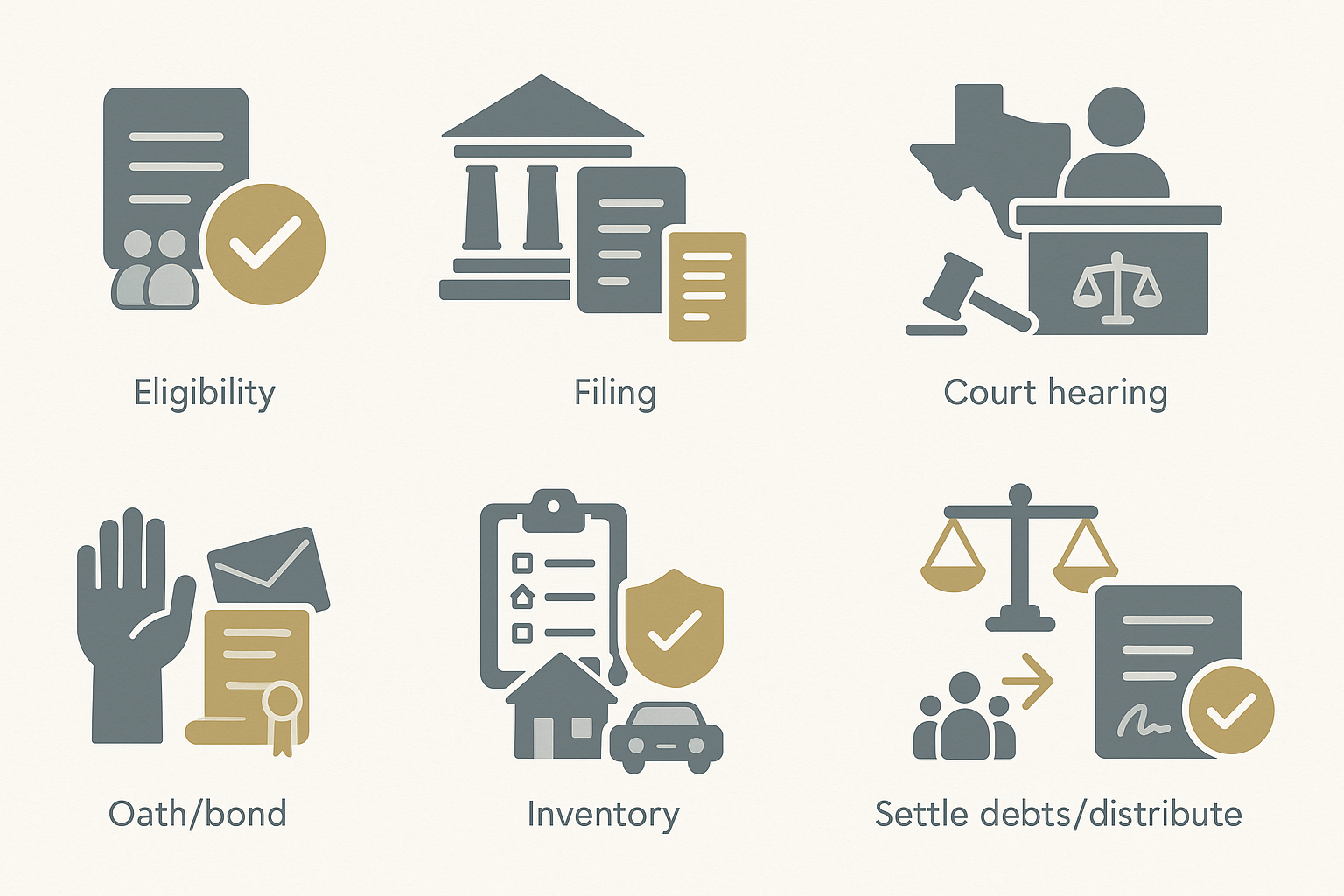

In-Text Image Prompt:

Create an informative, text-free illustration summarizing the 8 steps to open an independent administration probate in Texas. Use clear icons for eligibility, filing, court hearing, oath/bond, notification, inventory, settling debts/distribution, and closing, arranged in a clean, easy-to-understand layout.

Sources:

G.J. Chavez & Associates, P.C.

Texas Estates Code

Collin County Probate Court